Mail wire fraud, targeting philanthropic and political entities through impersonation and manipulation, requires a deep understanding of Understanding Regulatory Law during litigation stages. This knowledge is key to identifying applicable legal frameworks, serving justice, and protecting victims. The process involves regulatory bodies investigating suspicious activities, formal allegations, pre-trial preparations, and courtroom trials. Preventing such fraud demands a multi-pronged approach: adhering to laws on electronic communications and financial transactions, strict identity verification, data encryption, awareness education, and proactive law enforcement.

“Mail wire fraud, a sophisticated form of cybercrime, has become an increasingly prevalent concern in today’s digital landscape. This insidious scheme exploits trusted mail systems to defraud individuals and businesses alike.

This article aims to provide a comprehensive understanding of mail wire fraud, delving into its intricacies, the regulatory framework that addresses it, and practical litigation steps involved in seeking justice. We’ll also explore prevention strategies, emphasizing the importance of knowledge and proactive measures to protect against these deceptive practices, crucial for navigating the legal complexities surrounding this modern-day challenge.”

- What is Mail Wire Fraud?

- Regulatory Framework and Legal Provisions

- Litigation Process: Unraveling the Steps

- Prevention and Mitigation Strategies

What is Mail Wire Fraud?

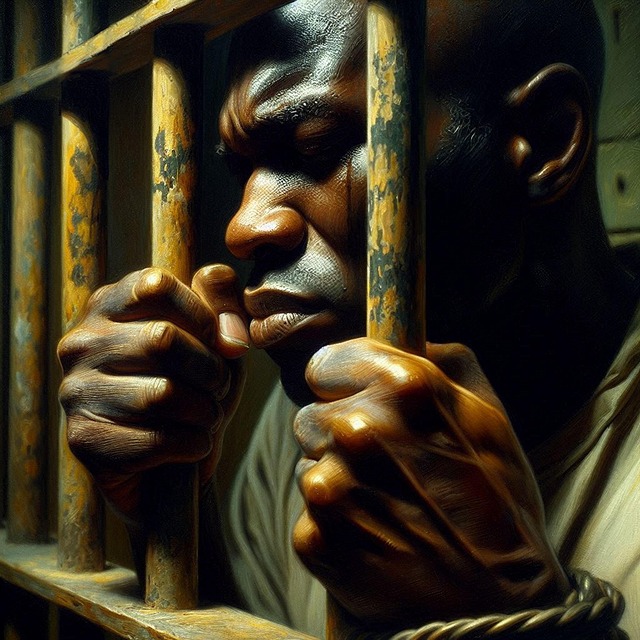

Mail Wire Fraud refers to a deceptive scheme where criminals impersonate legitimate financial institutions or individuals in an attempt to trick recipients into transferring money or sensitive information via mail or wire communication. This type of fraud often involves phishing emails, fake checks, or urgent requests for payment, leveraging psychological tactics to exploit victims’ trust. Understanding Regulatory Law is crucial during the litigation stages of such cases, as it helps identify the legal framework applicable to these fraudulent activities.

By targeting both the philanthropic and political communities across the country, mail wire fraudsters aim to achieve extraordinary results—defrauding individuals or organizations for personal gain. The complex nature of these crimes necessitates a thorough investigation, with each stage of litigation demanding meticulous attention to detail. This process ensures that justice is served and potential victims are protected from further harm.

Regulatory Framework and Legal Provisions

The fight against mail wire frauds is a complex interplay between regulatory frameworks and legal provisions. Understanding the Regulatory Law is paramount in identifying and mitigating these crimes, as it provides clear guidelines for financial institutions and individuals alike. This law establishes rules regarding data security, customer protection, and reporting obligations, ensuring that everyone involved acts within ethical and legal boundaries.

Litigation plays a crucial role in the process, with all stages of the investigative and enforcement process being utilized to achieve extraordinary results across the country. From initial detection of suspicious activities to the final verdict, each step is meticulously executed to ensure justice is served. The legal system’s ability to navigate these intricate cases is testament to its adaptability, aiming to stay ahead of evolving fraudulent schemes while providing a robust framework for effective prosecution and prevention.

Litigation Process: Unraveling the Steps

The litigation process in mail wire fraud cases involves a series of precise and regulated stages, deeply rooted in understanding regulatory law. It begins with an investigation by regulatory bodies who, upon detecting suspicious activities, issue subpoenas and request documentations. This initial phase is crucial for gathering evidence and establishing preliminary violations. Once allegations are formalised through a complaint or indictment, the case enters the pre-trial stage where both parties prepare their defences and strategies.

The heart of the process lies in the courtrooms, where jury trials often determine the outcome. Here, prosecutors present their case, supported by expert witnesses and compelling evidence, aiming to prove each element of the fraud beyond a reasonable doubt. The defendant’s legal team counters with its own evidence and arguments, striving for either a complete dismissal of all charges or, at the very least, mitigating the penalties. An unprecedented track record of successful defences or prosecutions can significantly influence public perception and future litigation strategies within this complex regulatory landscape.

Prevention and Mitigation Strategies

Preventing mail wire fraud requires a multi-faceted approach that combines technical solutions with robust regulatory frameworks. Understanding and adhering to relevant laws, such as those governing electronic communications and financial transactions, is crucial. Regulatory bodies across the country play a vital role in setting standards and enforcing compliance, particularly during the litigation stages of suspected fraud. By implementing stringent identity verification processes, encrypting sensitive data, and monitoring for suspicious activities, institutions can significantly mitigate risks.

Additionally, fostering a culture of awareness among both corporate and individual clients is essential. Educating employees on recognizing potential red flags and reporting suspicious transactions can serve as a powerful deterrent against white-collar and economic crimes. These proactive measures, when coupled with effective law enforcement strategies, help to create a more secure environment for financial transactions, ensuring the safety of individuals and businesses alike across the country.

Mail wire fraud, a sophisticated and prevalent crime, necessitates a comprehensive understanding of regulatory frameworks and legal provisions. By navigating the litigation process through defined stages, individuals and organizations can protect themselves. Implementing robust prevention and mitigation strategies, grounded in knowledge of regulatory law, is key to minimizing risks associated with mail wire fraud in today’s digital age.